Improve your credit with Rapid Credit!

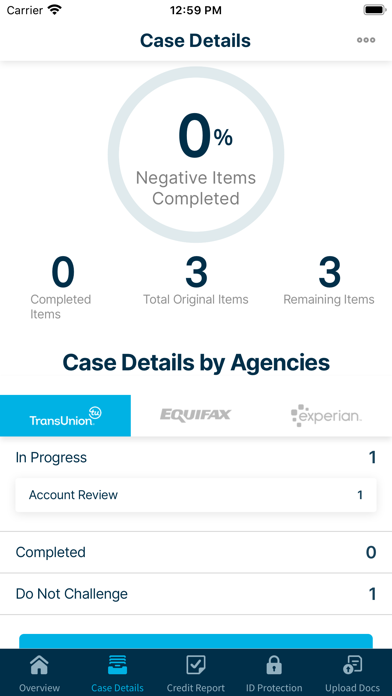

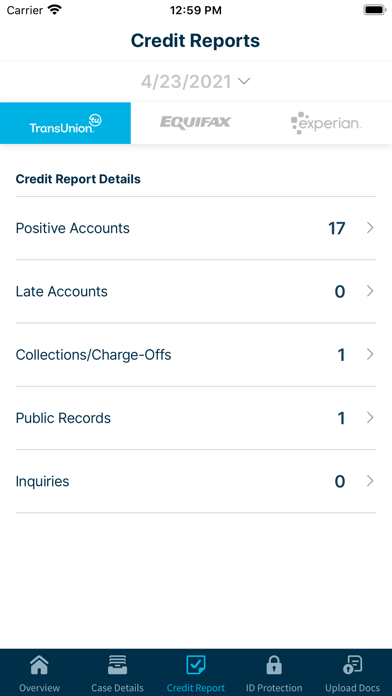

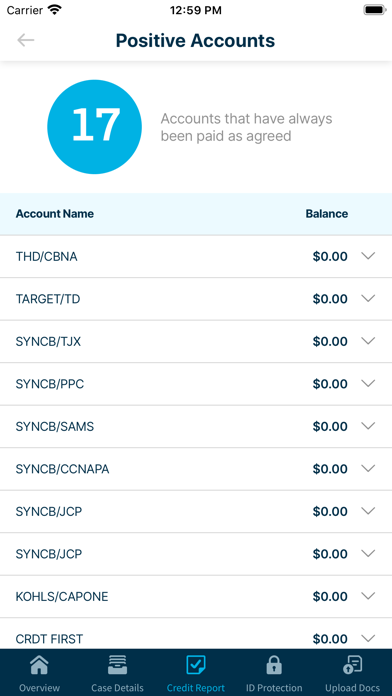

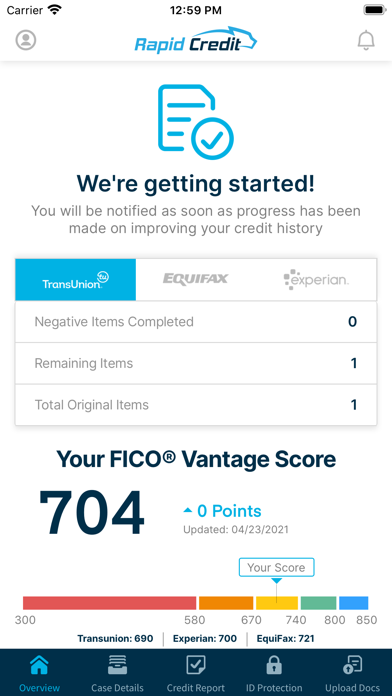

Rapid Credit will assist you in pulling a tri-merge credit report containing data from the three major credit bureaus: Experian, Equifax, and TransUnion. Rapid Credit features an exclusive document preparation process that is unique to our program and is customized to each member. It enables streamlined back-end processing and seamless communication between our members, Rapid Credit, and the Credit Bureaus; reducing the overall time needed to see results back from the credit bureaus.

3 Credit Bureaus:

Why all three bureaus? Not all “data furnishers” (i.e. lenders, credit card companies, debt collectors, etc.) report to all 3 bureaus and sometimes data furnishers will report different information to the bureaus. There may be errors that appear on one of your credit reports, that don’t appear on the other reports! Experience makes the difference when executing the proper plan for achieving your desired results. Our credit repair specialists can answer any questions and address any issue. Once any misinformation has been identified, Rapid Credit will assist you in preparing dispute documentation to send to the bureaus requesting that this information be removed from your credit report. Rapid Credit has designed an exclusive document preparation process, that we customize for each member.

After an item has been successfully challenged and removed, you will receive an alert on your smart phone app detailing the change and the positive effect it may have on your credit scores.

Credit reports are the most important reflection of your financial reputation; they’re what lenders use to decide whether to offer you a loan. Your credit report is a record of money youve borrowed, your history of paying it back, and how much you rely on the credit available to you. Your credit score helps lenders determine how likely you are to repay your debts. It plays a vital role when securing a mortgage, car loan, or other revolving or installment loans. Generally, the higher your credit score the more options will be available to you. The average credit score is 705. If your score is below 705, you can still get a loan, however you will not have as many options and your interest rate will be higher. The most favorable lending terms are given to those with the strongest credit. Consumers with low credit scores may not even be able to receive financing at all.

Fraud can affect more than just your personal finances; it may also affect your family, your reputation, and the people with whom you do business. Identity thieves have hacked unsecure computer networks and databases, stolen mail, skimmed information from credit card or ATM machines, and used many other methods to steal personal information. If you are a victim of identity theft, Rapid Credit has you covered! Here are just a few of the advantaged we offer:

Zero deductible.

Your entire family residing in your residence is covered.

You’ll be instantly alerted of important activity – just click the “not mine” button to stop identity theft!

Covers your cash out of pocket expenses incurred in your ID recovery.

Covers any pre-existing Identity Fraud you didn’t know about.

Replacement cost due to stolen Driver’s License or Passport.

Note: As all legal cases are all different, these results above are examples of the great possibilities of what could happen and should be expected nor guaranteed.